Step by Step Beginner’s guide to leverage trading on BitMEX

Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. If you’d like to turn a bear (falling) market into the opportunity to make a profit, you may want to consider leverage trading.

BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to 100:1, providing traders the opportunity to amplify their gains, as well as potential losses.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade.

What is leverage trading?

Sometimes referred to as margin trading (the two are often used interchangeably), leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance.

For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of 10:1, you can open a position worth 50 BTC. This means that if the market moves in your favor, you’ll be able to access 10 times the profits; however, it also has the effect of magnifying losses when the market moves against you.

Margin trading is risky, speculative and complicated, so it’s not suited to beginners and is best left to experienced traders.

How does it work?

Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to 100:1 on some contracts. However, the amount of leverage you can access also depends on the initial margin (the amount of BTC you must deposit to open a position) and the maintenance margin (the amount of BTC you must hold in your account to keep a position open).

When leverage trading cryptocurrencies you have two options:

- Going long. Opening a long position involves buying a contract because you believe it will increase in value.

- Going short. Shorting is when you sell a contract because you think its price will go down, and then you can buy it back at a reduced price at a later date.

When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. However, if the market moves against you and you’re in loss, your trade will automatically be closed and your collateral liquidated when the market reaches a certain price – this is known as the liquidation price.

Must read:Profiting in falling markets

One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. As a very basic example, let’s say you owned 1 BTC on December 18, 2017, when its value was peaking at above $18,737. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Had you then decided to buy back into BTC on April 6, when 1 BTC was worth $6,695, you could have made a profit of $12,042 (minus transaction fees).

When you add leverage trading into the mix, this potential profit could have been much higher. If you’d traded using leverage of 5:1, for example, your profit would have been five times greater – it’s this potential for much larger gains that makes leverage trading an attractive prospect to experienced traders.

How to leverage trade on BitMEX

How can you trade using leverage on BitMEX? Follow these simple steps:

While BitMEX offers several cryptocurrencies to trade, all profits and losses are settled in bitcoin, which BitMEX refers to as XBT (instead of the more often seen BTC). As a result, users must deposit and withdraw funds in bitcoin, rather than dollars, even though dollars are what the platform’s cryptocurrencies are traded against.

Step 1. Register for a BitMEX account

Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. You’ll then be emailed a link which you’ll need to click on to verify your email address. Once that’s done, make sure you enable 2-factor authentication to provide an increased level of security for your account.

Sign Up Now on official website BitMEX

Always enable 2-factor authentication when possible. BitMEX

Step 2. Deposit funds into your account

Click on the “Account” tab at the top of the screen to be taken to your wallet. Click the green “Deposit” button and scan the QR code or copy your wallet address. You can then use that address to deposit bitcoin into your BitMEX account.

The wallet also shows available balance and funds in open orders.BitMEX

Step 3. Navigate to the trading screen

Click the “Trade” link at the top of the screen. You’ll be taken to the trading screen where you can click the tab of the crypto you want to buy or sell – bitcoin, Cardano, Bitcoin Cash, Ether, Litecoin and Ripple are all available.

Several major cryptocurrencies are available to trade. BitMEX

Step 4. Enter the details of your position

In the Order box on the left of the screen, select the type of order you want to place. For this example, we’ll be using a Market Order. Enter the quantity of your trade, that is the amount you want to buy or sell in US dollars (USD).

Fill out your order details in the left hand column. BitMEX

Step 5. Set your leverage

Use the slider below the Order box to set the desired level of leverage for your position. In this example, our leverage is set to 5x.

Be careful when adjusting leverage. BitMEX

Step 6. Review the details of your transaction

Take a moment to review the full details of your transaction. The “Quantity” field shows the value of your position, but because you’re trading with leverage, the money you’re putting at risk is less than this. The “Cost” field details the maximum amount you can lose on the position if the market moves against you. “Order Value” shows the value of your position in XBT.

Step 7. Open your position

If you think the price will rise and you’re going long, click on “Buy Market”. If you’re shorting because you think the market will fall, click on “Sell Market”. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Review all details carefully before clicking on “Buy” or “Sell” to confirm your order.

Profit and loss case studies

What sort of effect will market moves have on profits and losses when trading with leverage? Let’s take a look at some hypothetical examples.

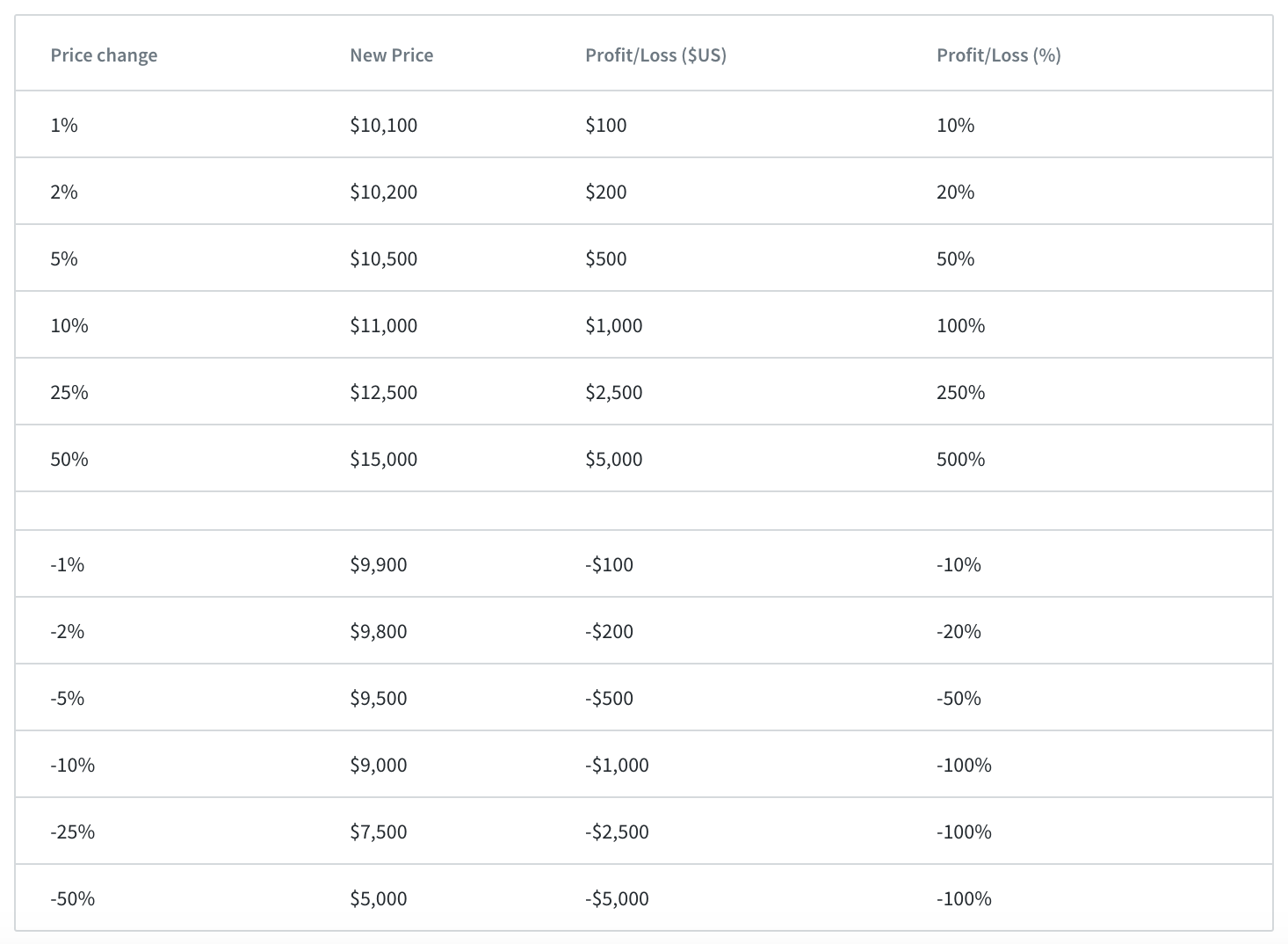

Going long with 10x leverage

For simplicity, let’s assume the value of your position is 1 BTC, which is $10,000, so the initial margin requirement would be $1,000.

Note: While your profit can exceed 100%, losses are limited to 100% of the margin requirement.

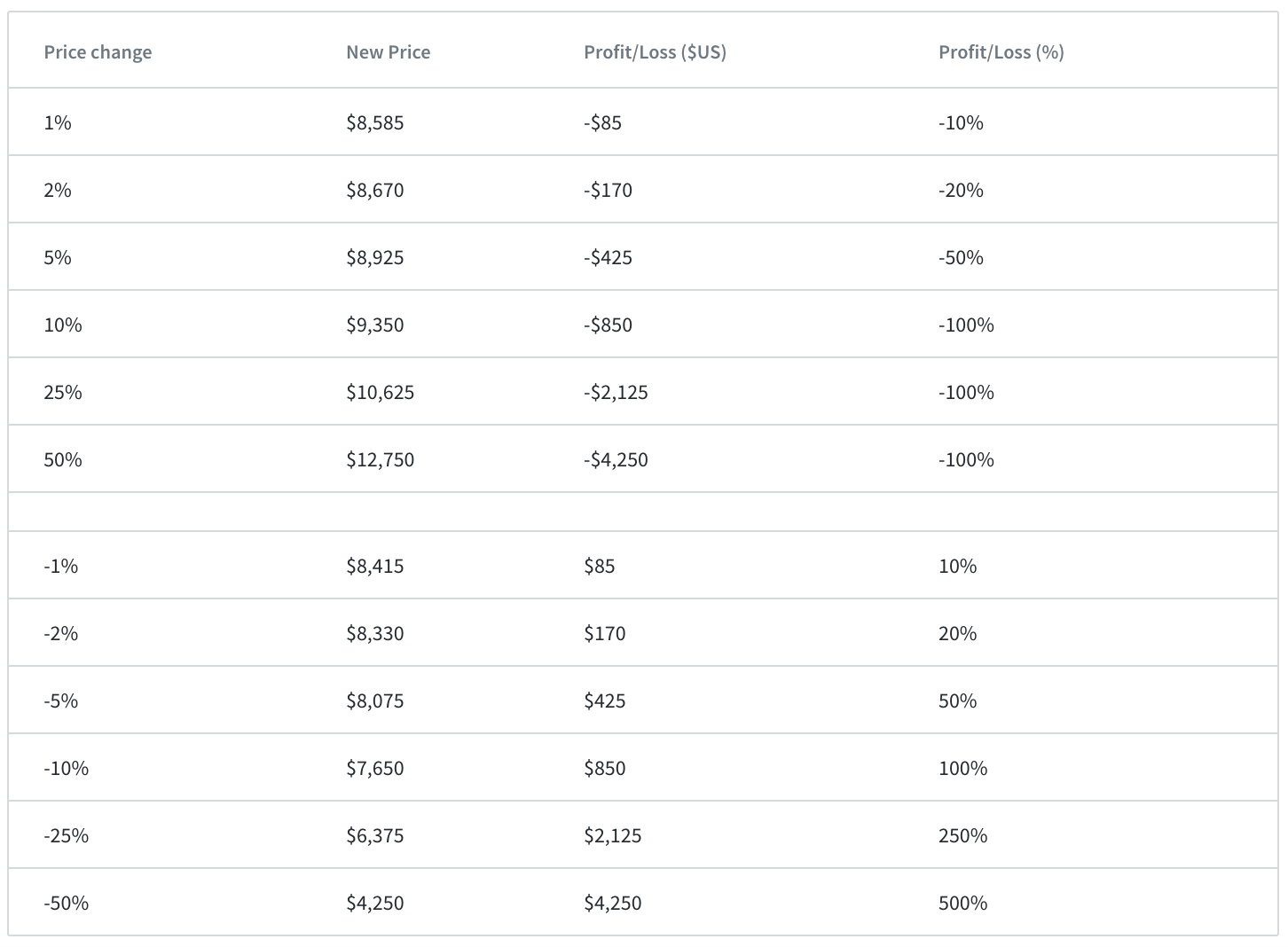

Going short with 10x leverage

In this example, we’re betting against the market and going short. Let’s mix up the maths a little bit and assume the value of your position is 1 BTC, which is $8,500, so the initial margin requirement would be $850.

Risk management tips

Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:

- Practice makes perfect. BitMEX offers a practice environment that’s set up to feel just like the real thing. This lets users get familiar with placing, executing and canceling orders while interacting with a simulated marketplace. Get used to the feel of things here before trading with real funds.

- Start with a small amount. When you’re first starting out with leverage trading, deposit only a small amount into your account. This way, if the market moves against you or you place the wrong trade by mistake, your losses will be minimized.

- Limit your leverage. Don’t get seduced by the potential maximum leverage available. Especially when starting out, minimize the amount of leverage you use as this will help limit risk.

- Pick a market. Rather than spreading yourself out across several different markets, focus on one particular market (for example XBT/USD) to develop a deeper understanding of price movements and trends.

- Understand your order. When setting up your first few trades, it’s essential that you study and understand the order screen. The field to pay particular attention to is “Cost”, as this shows the maximum amount you could lose from your trade.

- Use Limit trades rather than Market trades. When trading bitcoin, BitMEX charges a taker fee of 0.075% of the total position if you use the “Market” tab when opening a position. However, if you select the “Limit” tab to become a market maker, you’ll actually receive a rebate of 0.025% of your total position.

- Leave it to experienced traders. If you’re new to either online trading or cryptocurrencies, leverage trading is not for you.

If you know what you’re doing, leverage trading on BitMEX can be an effective tool to help you increase profits. However, make sure you’re fully aware of all the risks involved before deciding whether this is the right approach for you.

Glossary of key terms

Cost

The maximum amount you could lose on a trade

Initial margin

The amount you must deposit in your account to open a position

Leverage

Using a small amount of capital in your account to control a larger position

Limit price

The price you set to open a position

Long

Buying now with the hope of selling in the future at a higher price

Liquidation price

The price at which your position will be automatically closed

Maintenance margin

The amount of funds you must hold in your account to keep your position open

Order value

The total value of the position

Quantity

Your position size in USD

Short

Betting against the market, hoping for price to fall

source: https://telegra.ph/Step-by-Step-Beginners-guide-to-leverage-trading-on-BitMEX-07-30

Комментарии

Отправить комментарий